White-hatting Curve Finance for $6m

Published:

Introduction

Background

This post outlines the how Curve, I, and a few other white-hats saved ~$6m of LPs money through 2 rescues in the wake of the Vyper re-entrancy exploits. For those that are not aware, there was a compiler bug in a few old versions of Vyper which failed to utilize the same storage slot for re-entrancy locks with a common key. Many Curve pools were vulnerable. For more information, see the Curve and Vyper post-mortems.

Story Summary

Soon after the ETH/CRV pool was exploited the first time, I quickly discovered and reported a critical insight to the Curve team that would allow someone to easily drain 3.5k ETH from the liquidity pool. The war room implemented my PoC into a flashloan, but unfortunately we were frontrun. (See Chainlight post-mortem for more info). There was still about $1m left in the pool after these two exploits, and through a complicated exploit we were able to white-hat the remainder. I worked on this for 6 days and the adrenaline rush was real. The open arms of the Curve community was unexpected and it was incredible to work with some of the top minds in the space. The entire experience was very unique, so I thought I would share it with the world - read the timeline below for a detailed story of what transpired!

(Note: It is hard to precisely attribute credit with I/we, so the appendix includes full attribution)

Let’s go()

July 30th - Day 1

12:29 PST I see Spreekaway’s tweet sharing an exploit happened on ETH/CRV pool. I figured that the whole pool had been drained so I continue to scroll Twitter.

13:16 PST I look at the ETH/CRV pool for the first time and I notice that there is still ~5k eth in the pool and a nominal amount of CRV. By AMM invariant logic, it would seem that you could sell a tiny amount of CRV for a huge chunk of the remaining ETH. I ask myself: “why hasn’t this been done yet?”

To investigate, I start with cast call exchange(1,0,10**18,0,false) but it reverts. I open the pool code on Etherscan to read the exchange() function and I see that it uses internal accounting of balances rather than the actual balances. I figured that these might have diverged during the exploit. To confirm that this is the issue I check the balances() variable on Etherscan and see it return wildly incorrect values. if i can update the internal balances, the pool becomes unbricked and thousands of ETH are easily drainable.

13:41 PST I ctrl-f the pool code for self.balances to see where they update, it appears the only way to update them is by calling claim_admin_fees(), which anyone can do. I create a Foundry project and a test. I try to claim_admin_fees(), but it reverts. Not a surprise, I know from making stakedflip.fi fuzz tests that Curve pools tend to break at the extrema. I cheat some CRV, donate it to the pool, and claim_admin_fees() passes! I then add an exchange.

See the original test PoC here:

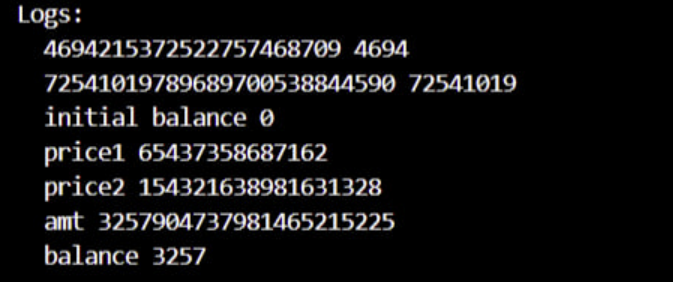

function test() public {

console.log(pool.balances(0),pool.balances(0)/10**18);

console.log(pool.balances(1),pool.balances(1)/10**18);

pool.get_dy(1,0,10**12);

console.log("initial balance", owner.balance );

console.log("price1",pool.get_dy(1,0,10**18));

vm.prank(0x5f3b5DfEb7B28CDbD7FAba78963EE202a494e2A2); // crv whale

crv.transfer(owner, 100 000*10**18);

vm.prank(owner);

crv.transfer(address(pool),30000*10**18);

pool.claim_admin_fees();

console.log("price2", pool.get_dy(1,0,10**18));

vm.startPrank(owner); crv.approve(address(pool),2**256 - 1); uint256 amt =

pool.exchange(1,0,70000*10**18,0,true);

console.log("amt",amt);

console.log("balance", owner.balance / 10**18);

}

You can see that ETH balance of owner increased from 0 to 3.2k with 100k cheatcoded CRV:

Boom, for 100k CRV, one can drain 3.2k eth. I start to work on wrapping this into a flashloan so I have a more solid PoC to share.

14:01 PST I decide that the Curve war room will act faster on this information. I post a tweet on Twitter since I wasn’t able to reach them via their Telegram channel. This was my first foray into white-hatting, but I know that time is of the essence.

Can someone from CRV team please contact me? can't reach you guys

— Addison (@0xaddi) July 30, 2023

and share a hash in case something happens.

sha256(you can drain the crv/eth pool right now by sending crv, claiming admin fees, and then selling crv into the pool for a thicc price. salt: 4G7P#QfC!YTsHYo4)

70de231f22679e3c255be4f23908a797e9f7a92795a46e108e61eaeeb0a59b39

— Addison (@0xaddi) July 30, 2023

14:07 PST Bout3Fiddy from the Curve team dms me in Telegram. I had seen him around but I was not sure what his role was on the Curve team so I ask him to tell Michael to dm me. I tell him that I have a PoC to drain several million USD and he tells Michael.

14:16 PST Michael reaches out to me and I share the exploit and the PoC

14:22 PST Michael confirms that its real and I ask him if I can join the war room so I can continue working on the PoC.

14:27 PST I’m invited to the war room and I give a recap of the exploit to the others:

hi

summarizing what i found

1) realized that the crv/eth pool was heavily imbalanced (almost no crv left).

2) under amm logic that would mean I can swap a few CRV for hella eth

3) that doesn’t work because the pool balances are what they were prior to the flash loan attack

4) the only way to update the pool balances is viaclaim_admin_fees()

5) anyone can doclaim_admin_fees()

6) doing it right now fails, you have to donate like 30k crv for it to go through okay

7) once it goes through you can swap for like 5k eth with 70k crv

I continue to work on the flashloan. I postulate skipping the flashloan and just buying CRV for the rescue as it would be significantly faster. This was a simple exploit and was surprised nobody had acted yet - I wanted to move quickly.

14:52 PST Bpak from Chainlight finishes the flashloan for the rescue that is able to retrieve ~3100 ETH, about an 85% recovery. There is some discussion about trying for more, but I propose that we take the 85% and try for the remainder after.

15:02 PST I notice that Coffeebabe has exploited the pool (at the time we did not know that CB had frontrun Chainlight’s leak). At this point I was disheartened because it was something that was so simple, and we were so close to saving it.

15:17 PST I highlight that the remainder of the ETH/CRV pool can be recovered. I begin to start work on this. We realize that this is not going to be a simple exploit since tweak_price reverts in every function besides remove_liquidity. Claiming admin fees no longer works.

I’m not familiar with Curve v2 so the others begin work to determine the underlying issue. I tried to re-compile the pool contract with additional logging events to debug, but I ran into many issues when trying to vm.etch in Foundry.

We realize that if we can get tweak_price to pass then we can recover the remaining funds. We try to figure out what the problem is.

July 31 - Day 2

13:38 PST After his analysis, Robert Chen (@notdeghost) discovers that that virtual price needs to increase by 25x in order for tweak fees to pass.

an argument for why recovering funds from the crveth pool is impossible:

to pass

tweak_fees, you need to increase the virtual price by a factor of 25x. virtual price can’t be increased under normal operation because this would require an increase in actual value for other lp token holders.I claim that (1) means you need to trigger reentrancy.

there are only three functions where you can trigger reentrancy.

remove_liquidityis the only one that can be called without a guaranteed abort, because the other two calltweak_pricewith cached balances.^1calling

remove_liquidityfirst results in a higher CRV balance. the rest of the analysis still applies, and all other function calls must abort.^1: this is workable if you can burn (100 - 1/25) = 96% of the balance during the reentrant call to decrease supply, but this seems unreasonable.

15:10 PST I decide that I should quit due to my minimal understanding of v2 maths (spoiler: I don’t quit)

August 1 - Day 3

7:12 PST Fiddy thinks the pool could be unbricked with another large donation

but perhaps it can be done via: flashloan > donate > claim admin fees —> manipulate vprice up —> add liquidity is unborked > manipulate vprice down again > mint a lot of lp tokens > remove_liquidity > repay ?

10:33 PST I un-quit and try many permutations of donation amounts and discover that donating 7m CRV and 10k ETH along with a claim_admin_fees will unbrick the pool. This is less than we expected.

Chen’s previous insight was nearly spot on, but it missed that you can manipulate virtual price by donating to the pool.

I setup the flashloan and work on replicating the original exploit now that we can get the pool into a drainable state.

21:04 PST My rescue contract is able to donate 18m CRV and 3.4k ETH and drain the pool down to 7m crv and 1.8k ETH. We realize that draining the pool down to zero will not be trivial - it will require a narrow range of parameters that don’t rebork the pool.

// exploit pseudocode

crv.transfer(pool, donationAmount)

pool.claim_admin_fees()

repeat 10-50x:

lpTokenAmt = pool.add_liquidity(lpAmounts)

pool.remove_liquidity(lpTokenAmt) // triggers fallback and allows for re-entrancy

// fallback

pool.add_liquidity(lpAmounts)

pool.exchange(0, 1, arbitraryNumber1) // purchase CRV

pool.remove_liquidity_one_coin(0) // remove all liquidity as eth

pool.exchange(1,0, arbitraryNumber2) // purchase ETH

Sometimes remove_liquidity or add_liquidity will return loss, exchange will transfer way more than the pool actually has, or tweak_price will just fail. It’s going to take a while for us to figure out how to manipulate donationAmount, lpAmounts, arbitraryNumber1, and arbitraryNumber2 optimally.

23:02 PST Chen iterates on our solution and gets it to drain the pool down to 356 eth and 48.8k crv

August 2 - Day 4

13:39 PST I spend the day trying to gradient descent on the parameters to minimize USD value of the pool. Ultimately it is not possible because the surface is not continuous. Steps that might massively decrease usd_val might re-brick the pool. I hypothesize doing some sort of DFS.

18:26 PST Nagaking starts to modify curve-sim to support re-entrancy to find the optimal exploit params. This involved adding a fallback parameter to the remove_liquidity that allowed you to perform operations prior to updating D after token transfer.

August 3 - Day 5

8:25 PST We try skipping the re-enter exchange and instead just add_liquidity inside the re-enter. This does not work.

16:10 PST Robert Chen gets the pool down to 70 eth and 24 crv, but with 100m+ gas. He explains that the exploit gives you a primitive to increase the pool's perceived CRV balance. thus, during the callback, you swap from ETH to CRV. This exploit technique gives you free CRV. you should get rid of as much CRV as possible at each step for ETH.

Essentially, the re-enter add_liquidity + exchange would inflate the amount of CRV the pool thinks it has. Because of the AMM invariant, this devalues the CRV that the pool actually has.

August 4 - Day 6

7:01 PST I tweak to a 2.7k CRV/ 376 ETH profit with a 135k flashloan fee and 40 eth left in the pool, and 16m gas. We decide we should try for a smaller flashloan fee.

7:44 PST I realize that the initial add_liquidity amount can be miniscule ( < 10**10 wei), which massively increases the efficiency of the loops. I ultimately realize that re-entering mid remove_liquidity allows you to perform operations, but reset the pool balances to how they should be post remove_liquidity. Thus the liquidity amounts should be as small as possible: lpAmounts ~= [0, 0].

I implement a loop of get_dy to dynamically calculate the amount of ETH and CRV to sell. Because the pool’s internal balances are so inflated, exchange would begin to revert after a large number of loops because the pool would transfer out more tokens than it actually had.

uint256 crvamt = crv.balanceOf(address(this)); // ideally we sell all the CRV we can

uint256 dy = 2**256 - 1; // start at the max for the loop

while (dy > address(pool).balance) { // once we receive a feasible amount, we proceed

crvamt = crvamt * 9 / 10;

// the pool is so borked that get_dy doesn't work for some amounts

try pool.get_dy(1,0, crvamt) returns (uint256 _dy) {

dy = _dy;

} catch {

crvamt = crvamt * 9 / 10;

}

}

// the ETH amount is simpler

uint256 a = 250*10**18;

while (pool.get_dy(0,1,a) > crv.balanceOf(address(pool))) {

a -= 1*10**18;

}

These were the two key insights that allow inflation of the pool internal balances to the maximum. After the loops finish, the pool thinks it has billions of crv, thus we can swap ~1.5 ETH for all the CRV left in the pool (~50m).

I’m also able to reduce the flashloan fee to 45k CRV by changing the initial donation params to have more ETH.

12:55 PST I get the pool down to 37 ETH and zero CRV with a 45k crv flashloan fee and 27m gas. I tried many other parameter tweaks but was unable to get the ETH amount lower. It requires more CRV to sell, which requires paying more in flashloan fees then possible ETH to recover.

14:01 PST We get Scott Bigelow from Flashbots to help us submit the transaction. I combine the exploit into one contract and add a direct transfer to the contract controlled by veCRV holders. This way Curve DAO can transfer funds to an immutable distribution contract once the dusts settles.

16:17 PST Scott begins to submit the payload via a modified version of searcher-sponsored-tx. When one submits a bundle, they specify the block number it should be included in. This repo resubmits the bundle for each block until it lands onchain.

We nervously wait for 15 minutes for a validator to pick it up. We continue to wait because the transaction would fill an entire block, possibly messing with some validators configurations.

Ultimately, the transaction does not land on chain. We determine that it is due to incorrect gas estimations in our simulations.

17:27 PST I do another gas optimization and get it to easily fit within a block.

18:44 PST The pool state updates and I have to update the rescue params. It costs way too much gas to calculate the swap amounts on-chain, so the contract includes a flag on whether it should dynamically calculate or use swap values from calldata.

18:50 PST I compile the new contract and send the bytecode over to Scott. He submits the bundle again, and within 30 seconds, the rescue lands on chain. I nervously opened Etherscan to see if it succeeded or if we got frontrun somehow. Luckily, we did not - we saved ~$700k!

I along with @NotDeGhost, @CurveFinance team and @epheph have white-hatted ~$700k from the ETH/CRV pool (371 ETH and 92.5k CRV). Funds were sent atomically to the Aragon contract controlled by veCRV voters. They will be moved to a distribution contract for LPs to claim.…

— Addison (@0xaddi) August 5, 2023

Txn: 0x006763dff653ecddfd3681181a29e7e6d6c2aaa7bafb27fe1376f3f7ce367c1e

Learnings

This was my first white-hat experience and I learned a huge amount through the process. There’s a few things I’ll do better next time.

Flashloan Templates

I knew how flashloans worked but I hadn’t implemented one before. It would have been super helpful if I had generalized flashloan templates with all the major providers (Uniswap, Balancer, Aave) and a registry of all the pool addresses on all chains. Finding all the interfaces and pool addresses, especially for aave v2 which was on an old compiler version took alot of time and this is something that could be easily prepared for ahead of time. If I had these templates prepared I could have made the original flashloan PoC in 10-20 minutes.

Private RPCs

As we saw with the several frontrunnings, these payloads must go through a private RPC. We spent some time looking for the best RPC and figuring out how to submit to it correctly. Scott from Flashbots ended up helping us submit the payload. He uses a modified version of this. I plan to test out this repo so that if the time comes again, we don’t need to spend time figuring this out. There’s also a 2% chance that a block could be re-orged; this arises from validators proposing blocks too late or congestion in validator p2p. Block builders guarantee transaction privacy until block inclusion - once the block goes loose anything goes and transactions inside of a re-orged block could be repurposed. If for example this block was re-orged, Coffeebabe would have been able to simulate the exploit and frontrun it. If the exploit is several hundred million though, a malicious validator might try to reorg anyway. It could be worth setting up a service with trusted validators that allows sensitive payloads to land on-chain only if the validator set has several slots allocated in a row. Lido would be a good place for this.

Confidentiality

I generally do not like to promote or share a ton of information; however, many people in the web3 security space do. In the short term it might be better to tweet alot about ongoing exploits to build Twitter clout, but in the longer run its more +ev to stay quiet since the people that actually matter will notice your good work. I did not realize the magnitude of importance of this, and its a consideration I had while even determining to write this post.

Communication Clarity

Its really important that in these events that the communication is spot on. Nearly every piece of communication during this process was reviewed by multiple different parties. I did not do this for my tweet announcing the white-hat and there was some confusion. Napgener, although a fudster, and some others thought that this was a completely novel exploit but, in reality it was a variant of the original CRV/ETH exploit on the same pool.

another crv/eth bug lol.

— Napgenus ursus🧸🎯 (@napgener) August 5, 2023

whitehat saved $700k this time.

sickening.

nobody will ever trust defi again

you got fools aping into $CRV tokens at 40c in mid 8 fig size?

with critical vulnerabilities still live and team saying "its all safu"https://t.co/qvUf4GfBaI pic.twitter.com/P9srmHEGTj

Wait…. Are there still iffy contracts out there on Curve?

— DeFi Addiction (@DeFi_Addicti) August 5, 2023

Curve Math

Learned a lot about Curve math and increased my muscle of learning something complex quickly under time-pressure, and just trying to understand the essential components.

Credit Attribution

Please read below for explicit “who did what.”

White-hat #1

I found and shared the original PoC for the donation + claim_admin_fees + exchange that allows the majority of the pool to be drained Chainlight wrapped the exploit into a flashloan, but inadvertenly leaked the exploit. Coffeebabe frontran and returned the funds

White-hat #2

Group as a whole found that tweak_price was the issue I said that if we got tweak_price to pass we could repeat the original exploit Robert Chen determined that virtual_price needed to increase by ~25x for tweak_price to pass. Bout3Fiddy said that we could do another donation + claim_admin_fees to increase the virtual_price I found the donation params that worked and repeated the original exploit in flashloan Robert Chen did a big optimization that made the exploit profitable and determined how the exploit worked I determined the add_liquidity amount could be near zero, added the optimized exchange amounts, and reduced the gas usage Scott Bigelow from Flashbots bundled the transaction and brought it to the chain privately via Flashbots relay